Transport Update 26th May 2021

Scroll to find out more

Scroll to find out more

| Rates | Rate levels for June have not been released by carriers but the expectation is for rates to continue to increase. Another GRI has been announced by Hapag from Indian Sub Continent to the USA of $600/40’and $480/20’ from the 15th June. |

| Capacity | Blank sailings are still expected in June but with an improvement compared to May. Rail car shortages remain for services from Los Angeles/Long Beach as well as limited trucking availability, with trucks managing to perform only half the number of daily journeys they used to, effectively reducing the capacity by half. |

| Equipment | We are still observing chassis shortages in Los Angeles/ Long Beach. |

| Ports | The amount of vessels waiting to berth has shown no signs of improvement, with projections expecting congestion until the end of the summer. Average waiting times are 6 to 8 days in Los Angeles, but up to 15 days in Long Beach. The previous escape route of Oakland is now a congested port with as many vessels waiting to berth as Los Angeles/Long Beach and an average waiting time of 15 to 20 days. Chicago Inland rail terminals are still very congested with chassis shortages, limited daily allocation and gate-in. Waiting times for drivers are around 3 to 4 hours for export loads. |

| Rates | As the carriers announce their rates for June, the upward trend has continued, with carriers pushing for increases of $1000/40’. The trend now, however, is to add extra premiums of $1000 to $1500/40’ to be able to gain access to the space. |

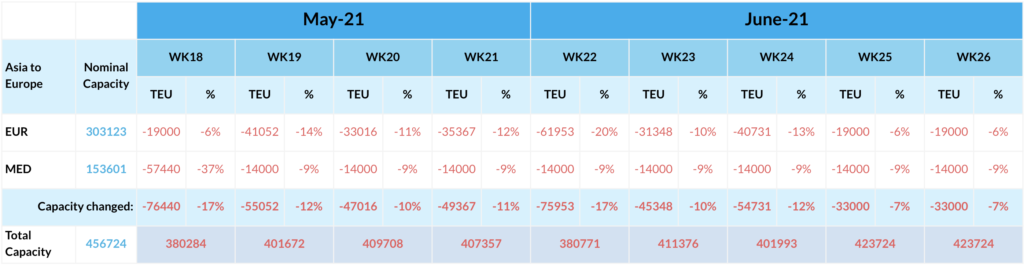

| Capacity | A continuous reduction of capacity of about 9% from China to Europe is expected. Space is very difficult to obtain with regular instances of rolled cargo. OOCL has continued their booking stop for all the FOB contracts from Asia due to the excess volumes it needs to ship from Asia contracts.

From India the disruption caused by the bad weather is expected to cause build up of cargo that should be cleared in the week. However, the situation in India and the rest of the Indian Sub Continent is one of capacity shortages due to blank sailings and equipment shortage, as a generalised trend of what we see across the whole of Asia. |

| Ports | Yantian port has reported COVID-19 cases which have put a halt to the normal operations. The gate operations have been delayed for temperature checks which has caused a buildup of traffic around the port with queues of 7h. This is expected to cause delays to shippers as cargo might miss the deadline to enter the port for vessel operations. |

| Rates | Rates released for June indicate an increase of $500/40’ of equipment imbalance and another $500/40’ of Peak Surcharge. |

| Capacity | Vessels still are reportedly full until mid June, with bookings placed under 3 weeks before the sailing of the vessel not likely to get space. |

| Equipment | The shortage of chassis continues to affect the areas of New York, Philadelphia, Cleveland, Columbus, Atlanta, Nashville and Louisville. |

| Capacity | Ports are still congested in the yards with the current time to remove the container of the ports of New York/ New Jersey of about 6 to 8 days compared to the average of 3 days. The Inland rail terminal of Charleston is suffering delays due to the backlog of units needing trucking services in and out of the terminal. |

| US | The market is not as busy as last week, but rates have remained at high levels. There are spot rates available for heavy dense cargo |

| EU | The market is very similar to the US market and was not as busy as last week. There have been some flight cancellations which have meant rates have not decreased much at all. There are spot rates available for heavy dense cargo. |

| UK | For the UK market there are some direct flights with CA/BA and rates are also still at high levels but are expected to decrease slightly in the coming weeks. There are spot rates available for heavy dense cargo |

| Capacity | Ports are still congestion in the yards with the current time to remove the container of the ports of New York/ New Jersey of about 6 to 8 days compared to the average of 3 days. The Inland rail terminal of Charleston is suffering delays due to the backlog of units needing trucking services in and out of the terminal. |

Multiple factors continue to drive demand for scarce are capacity and keep upward pressure on rates. The return of robust consumer demand has come at a time when ocean freight is especially expensive and unreliable, especially in the US with Asia-US rates up about 25% to most destinations in April and remaining elevated through May. Rising fuel costs are also putting additional pressure on prices, pushing carriers to raise rates. Despite vaccine progress, rapid COVID testing kits remain a key part of testing strategies. These conditions are likely to keep rates elevated for some time.

Despite new services being launched by sharp eyes carriers, space still remains tightly constricted. The return of some commercial travel ex-UK has potential to increase capacity but industry groups are still warning of tight capacity and high prices ahead.

| Availability | Availability is steadily returning to the market following caution from carriers over border situations. |

| Rates | Prices have increased slightly following local lockdowns in Turkey and limited availability from Italy. |

| Customs | Customs clearances are still the main bottleneck in road transportation booking, with clearances taking multiple days. |

The information that is available in the Weekly Market Update comes from a variety of online sources. Click below to learn more about how Zencargo can help make your supply chain your competitive advantage.

In Focus: India-Pakistan Ceasefire and European Congestion Last weekend’s cease...

In Focus: An update on U.S. tariffs The de minimis exemption for Chinese and Ho...

In Focus: Tariff turbulence continues to disrupt Escalation in U.S. tariff poli...